This month I found a retirement survey online published by the Ontario Securities Commission called Profiles of Retirement

It surveyed people over 50 years of age who were a) preparing to retire or b) already retired. The sample size was 1500 people.

Here are some charts from the report that I found interesting:

The red highlights were done by the OSC - the overarching body for financial planners and advisors in Ontario. I assume the highlights are there to bring attention to areas of importance to the financial planners/advisors. Bear that in mind as you look at the charts.

Investment Products Owned - what surprised me:

The amount of people who hold mutual funds. These funds usually come with higher than average fees. If the returns out pace the market by a lot, perhaps the fees are worth it, but if they don’t, at the end of the day that could mean less money in an investor’s pocket.

That individual stocks and ETFs are held by less people than GICs or Term deposits. It seems to me that people are still worried about investing on their own or they feel it is better to pay (a fee) to have someone do it for them. I really wish more people took an interest in their money when it comes to investing.

That 10% of those surveyed don’t know what investment products they own. Ok, this one was the biggest shocker for me. I know that ten percent isn’t a lot, but it’s still ten percent! How can you not know what investment products you own?

That 35% of respondents don’t own any investment products (red highlight). How can this be that high? Are the majority who selected this answer in the pre-retiree group, or do they all have company pensions???

Personally, we only hold individual stocks.

Sources of Income - what surprised me:

The top line represents CPP but isn’t indicated in the table; I’m not surprised with the percentages here.

Look at the difference between retirees and pre-retirees when it comes to an inheritance. I’m glad that pre-retirees aren’t expecting one. It’s never a good thing to expect money because if it doesn’t happen you might find yourself in some trouble.

That 6% of pre-retirees have no idea where their retirement income will come from. Yikes. Again, six percent isn’t that high but I would like to see this at zero. If you are over 50 and don’t know how you will fund your retirement, get on it. This needs to be figured out.

For us, our sources of income are pension income, investment income and rental income.

Draw Down Strategies - what surprised me:

The first row surprised me. You’ll see that the majority fell between the ages of 50-59 which makes sense, but look at the non-investors vs investors in the note to the right and the gender difference of over 10%.

We would have fallen into the second row if we had been asked to participate in this survey. There is no set formula for us. We cash out when/if we need to. Having the extra sources of income, outside of our pensions, does help. It’s a shame that research on retirees living off dividend income isn’t more widely available to counter the share sale mentality but that debate is for another day.

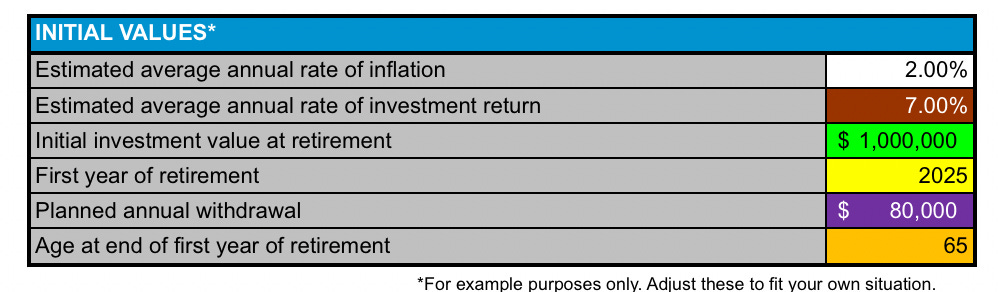

Speaking of selling shares… I love the downloadable spreadsheet at Get Smart About Money where you can put in your portfolio size at retirement, the amount of money you need (or want) annually and it will calculate how long that money will last. It’s a ball park calculation, but at least it will give you some kind of idea of how your retirement could play out.

Here’s a scenario I ran with these parameters:

In this case, a million dollar portfolio will be depleted by age 84. Considering most Canadians live longer than that, this is not ideal. Let’s not forget CPP and any other sources of income will be added to that $80,000 withdrawal.

I ran other scenarios to see what withdrawal amount would sustain a one million dollar portfolio up to age 95. Same assumptions as last time, with the only difference being the withdrawn amount. Given those parameters, the magic number was roughly $65,000 annually up to age 95. Again, CPP and OAS or any other income would be added to this amount. This is strictly a drawdown from your portfolio (cashing out shares).

Bear in mind, that any calculator you find online, like this one, is a rough estimate. But… it’s always fun to play around with the numbers just to see how long or how quickly your portfolio will last.

Retirement Income

It is very important to know where your retirement income is coming from and to plan accordingly. The stock market fluctuates by the second and when there is an economic or world crisis, this can drastically impact your portfolio value and possibly your drawdown strategies.

Dividend income is not a guarantee, but what I love about this income strategy is that the companies are blue-chip Canadian companies that have stood the test of time. They have seen many market crashes over decades (or our banks over a century!) and they have continued to pay a dividend.

For that reason, I feel more comfortable investing in dividend growers. I won’t have to run the numbers using a calculator like the one above because my dividend income provides a nice buffer.

Our income has grown every year without fail (and we even cashed out some money a few years ago). Our core holdings will forever be the ones that most dividend investors own - the banks, the pipelines, the utilities, and the insurance companies. They were the key players in helping us retire in comfort.

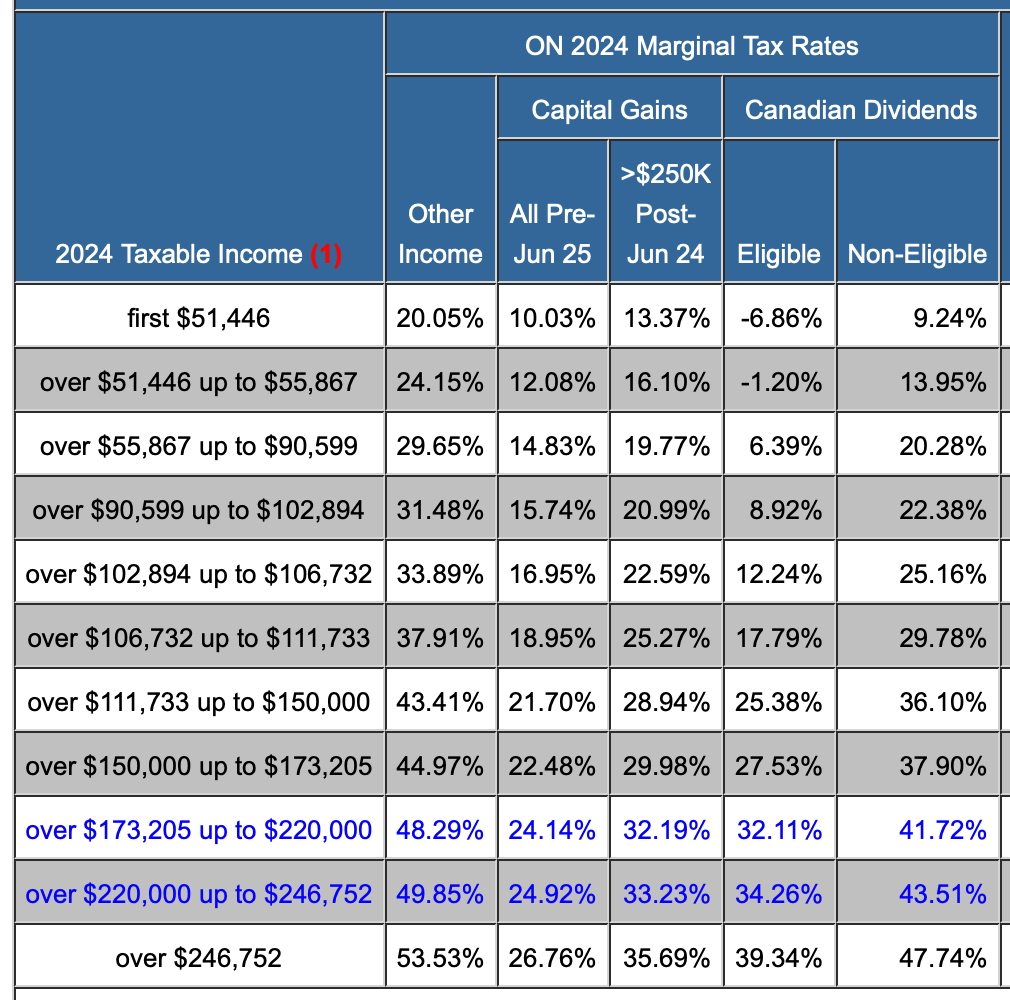

I will never subscribe to the “sell shares for income” strategy. Take a look at the differences in eligible dividends vs capital gains below (for Ontario). The blue highlighted is an increase over last year with a change in income brackets also.

To see this chart as it pertains to your province, go to the taxtips.ca website.

I am comfortable knowing that my dividend income comes with a tax advantage up to a certain point. After that point, I may have to pay a few extra percent or two, but in the grand scheme of things, if I’m making that much money I’ve certainly done something right!

Be confident in your future retirement by understanding what you own and why. Imagine if your retirement income was solely made of dividends. You’d pay very little tax, if at all. Have a plan and make it come to life. The earlier you begin thinking of it, the better off you’ll be.

August Dividend Income

In August we earned