"Education is the most powerful weapon which you can use to change the world."

- Nelson Mandela

We always encouraged education in our household and our kids grew up knowing that post-secondary education was in their future. We didn’t force it, but we also didn’t talk about any other option, so it just became something they knew they would do.

When the time came, they were both very eager to go off to university. Either college or university would have been fine with us (my husband went to college, I went to uni), but we both felt that doing a post-secondary degree and the experience it brought, not only for life but for learning, was something that couldn’t be missed by our kids.

Never in a million years could we have predicted they would both decide to pursue a Master of Science programme and pay for it themselves, one in Molecular Genetics and the other in Mathematics (that’s my proud parent flex!).

At the time, we were the old school parents who didn’t get it; who couldn’t see the appeal of a Masters and weren’t sure if all the work, time and money would make it worthwhile. But that decision wasn’t ours to make and thankfully they chose to put in the hard work for their graduate degrees.

I write about this today because it makes me think about the quest for knowledge and the passion to learn something new. Post-secondary education makes you question with an eagerness that isn’t present in high school. It makes you think critically, to research, to read, and to make decisions that have consequences. It’s that first step to becoming a life-long learner.

This brings me back to last month’s post of the retirement survey and how many pre/post retirees had no idea what investments they had in their portfolio or even where their money for retirement would be coming from. That scared me.

I think it’s really important to encourage the quest for knowledge when it comes to topics that impact our every-day life, like learning how to manage our finances, budgeting and saving/investing. You should never make any life changing decision blindly.

I was about 27 when I first picked up a copy of Rich Dad, Poor Dad and it literally changed my life. It seems so funny to think about now… that a book had such a profound impact on me but it really opened my eyes to the benefit of investing in money-making assets.

From that moment on, my goal was to become a real estate investor and I started to plan a way for it to happen. It took 8 years after reading that book before our first vacation rental was purchased. I can still hear our financial advisor telling us how crazy we were to buy real estate instead of putting money into much safer investments like the funds he offered. He clearly hadn’t read Rich Dad, Poor Dad.

Keeping and growing our money was important to me and so I began reading and learning about various investment strategies even more (like dividend investing). There have been hundreds of financial self-help books written since then and they are free to borrow at the local library. You can read blog posts, newsletters, the newspaper or magazine articles related to investing and personal finance. There is so much available at the click of a mouse.

I would never give someone else complete control over my money. If you do and they lose it all, is that on you for allowing them control or is it on them for losing your money? I think you know where I stand.

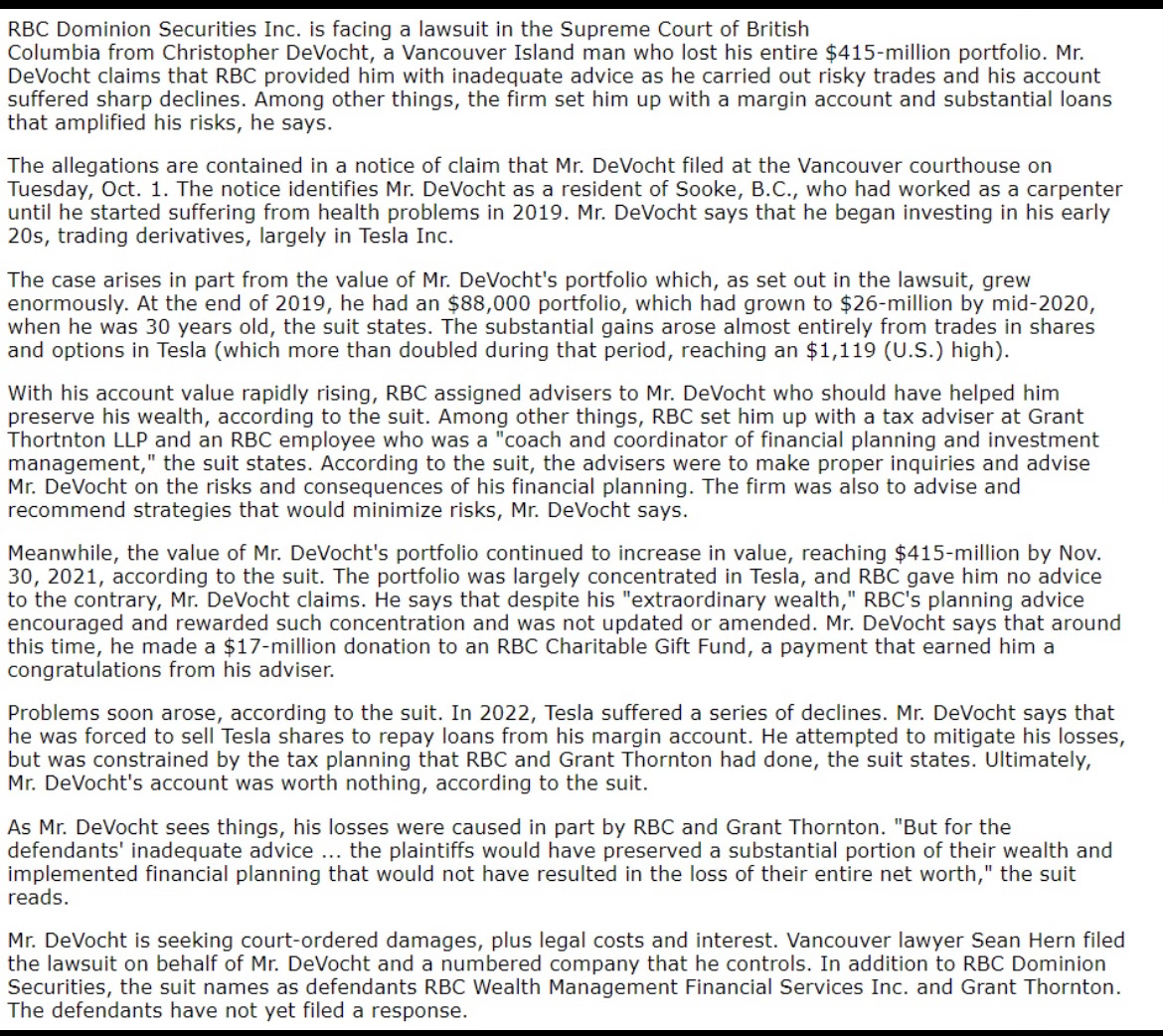

So here’s a situation for you that I recently saw on Twitter/X and it’s become a viral article on many media sites, such as the CBC, the National Post, BNN Bloomberg and more. Just google the guy’s name and you’ll find it.

The sad part is, there are countless other stories like this where people have lost large sums of money because they didn’t do their own due diligence.

Listen, investing is risky. Everyone loses money at some point in time. You can’t trust anyone with your money, which is why my preference is to manage my own portfolio. If I lose it all, it’s on me.

The goal when it comes to investing is to mitigate your risk as much as possible and how you do that is to educate yourself on various investment options and know what the risks are ahead of time. Go to the library and borrow those books. Start researching online to learn more.

Whether you choose to take on the risk or not is completely up to you, but please don’t blame others if it doesn’t work out in your favour. It’s your money, so it’s your responsibility to grow it and keep it.

The learning should never stop.

"Education is the passport to the future, for tomorrow belongs to those who prepare for it today."

- Malcolm X

September Dividend Income

Our September dividend income represents an increase of 13% over last September, which is a pretty nice raise.