February 2023

My parents were avid dividend investors and when it came time for me to open my first investment account, they were the ones I turned to. Until then, I hadn’t paid much attention to the markets and had little knowledge on what to buy. Thankfully, my parents were there to guide me.

I can’t recall what I purchased first, but it would have been BNS, ENB or TRP as I’ve held those companies for years. Later, after saving up enough money, I added BCE and PPL to the mix.

I learned that investing in dividend stocks was pretty easy. If I could forego the urge to sell my dividend payers and continue adding to my portfolio, my dividend income would slowly grow.

Over the years, I never waived from this strategy, except to purchase a few growth stocks, here and there, that never seemed to work out in my favour.

Some people believe dividends are irrelevant and that investors should focus on value, growth, and total return. But as dividend investors, we do focus on those, except in dividend-paying companies.

Dividend investors look for a company that is undervalued (reasonably priced). If a company has a solid track record of increasing dividends then their share price will likely follow over time (growth). This allows an investor to build a dividend income while also earning capital gains from appreciated share price (total return).

Take BNS for example. It’s been in the doghouse lately for a lot of investors, and I’m not exactly sure why. Yes, it came out with lower than expected earnings for Q1, but as a dividend-growth investment it’s one to consider.

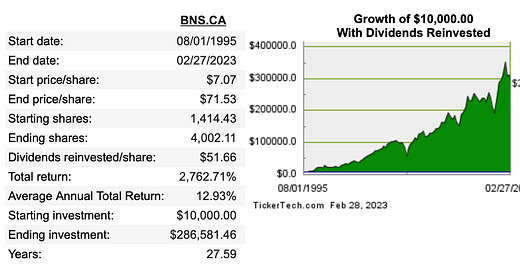

Here’s a chart showing how BNS has grown since 1995 (the year I made that first deposit into an investment account). This chart represents the growth of $10,000 (with dividends reinvested) up to February 27th, 2023.

A $10,000 investment would have grown to $286,581. Pretty significant. This works out to an average annual total return of almost 13%. That’s nothing to complain about.

Are there other stocks that have outperformed BNS? Sure. But I don’t like to gamble on trying to pick a winning stock. I just look for solid dividend-growers, and BNS certainly fits that bill.

Speaking of dividend-growers, in August 1995 (referred to in the chart) the stock price was $7.07. The annual dividend at the time was $0.31. They now pay $4.12 and are trading at roughly $67.80 at time of writing. This means an investor who had purchased them in 1995 would have an unrealized capital gain of $60 per share and their yield on cost would have grown to 58%. Wow!

Many people think that yield on cost doesn’t matter, but they are clearly not invested for long.

If you are someone that has the patience, this strategy works. The younger you start, the more you can build, but you must stay the course. Wavering will only set you behind.

Research the companies that fit the dividend-growth model, then buy, and hold them for decades.

Dividend-Growth Analysis

What makes a dividend-grower and how can you tell which companies fall into this category?

Well, that’s a good question, and all investors have their own specific criteria. You will have your own as well, either now, or in the future.

Here’s a list of 8+ questions I ask myself before purchasing a company: