Dividend Income Update - August 2022

Can you believe it’s September already…where does the time go? I hope you had a wonderful summer.

In August, we visited the shores of Lake Huron just north of Goderich where I tried my hand at golf. I had a pretty good round considering I have only played a handful of times. I am hoping to take lessons next year and play a lot more once my husband retires.

We also spent a lovely Saturday afternoon in Stratford, Ontario. If you happen to find yourself in this gem of a town, I recommend a cocktail at The Relic Lobby Bar. With its art deco Cuban vibe, the yummy cocktails served in vintage glassware are sure to impress. We stopped there for a tasting before walking along the river to the Festival Theatre where we saw Chicago. Stratford is beautiful, even if you go with a picnic lunch to just sit by the river with a book in hand, it will not disappoint.

Portfolio Musings

Volatility has been the word of the day - month - year. I am thankful to be invested in dividend stocks that continue to increase their payout.

The share prices may have gone down but my income just keeps growing.

Last year at this time, we had collected $17,021.11 in dividends (Jan-Aug 2021) as compared to $23,422.24 this year. That's an increase of over 37% or $6,401.13.

Wow, what a difference a year can make.

So far this year we have:

deposited $24,300 of new money into our portfolio (this includes our TFSA contributions, plus additional deposits)

received $23,422.24 in dividends YTD that have been reinvested

cashed out $23,000 from our portfolio

I'm pretty happy with what we've been able to accomplish this year up to this point. Next year may look a lot different with my husband retiring as we won't have as much disposable cash to put into our investments.

With his retirement only a few months away, I thought I would provide a recap of how we will cover our living expenses at that time:

my husband's defined benefit pension with 30 years of contributions

my defined benefit pension with 12 years of contributions

rental income

RRSP withdrawals

dividend income / cap gains from taxable non-registered accounts owned jointly

dividend income / cap gains from taxable non-registered accounts owned individually

TFSAs

Next year will definitely be a turning point for us and it will be interesting to see how our portfolio/dividend income grows from there.

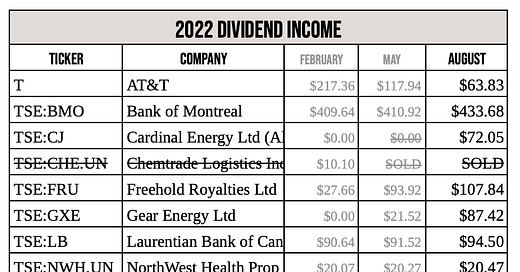

August Income Highlights:

August is one of our lowest paying months and it’s tough to go from a high of $4,252.97 in July to a low of $1,546.97 in August. That’s quite a difference.

Perhaps I should add more shares of BMO and RY to boost my income?

Total dividends received for August 2022 $1,546.97

This is an increase of almost 28% YoY (August 2021 vs August 2022)

The total received YTD is $23,422.24

This means we’ve reached